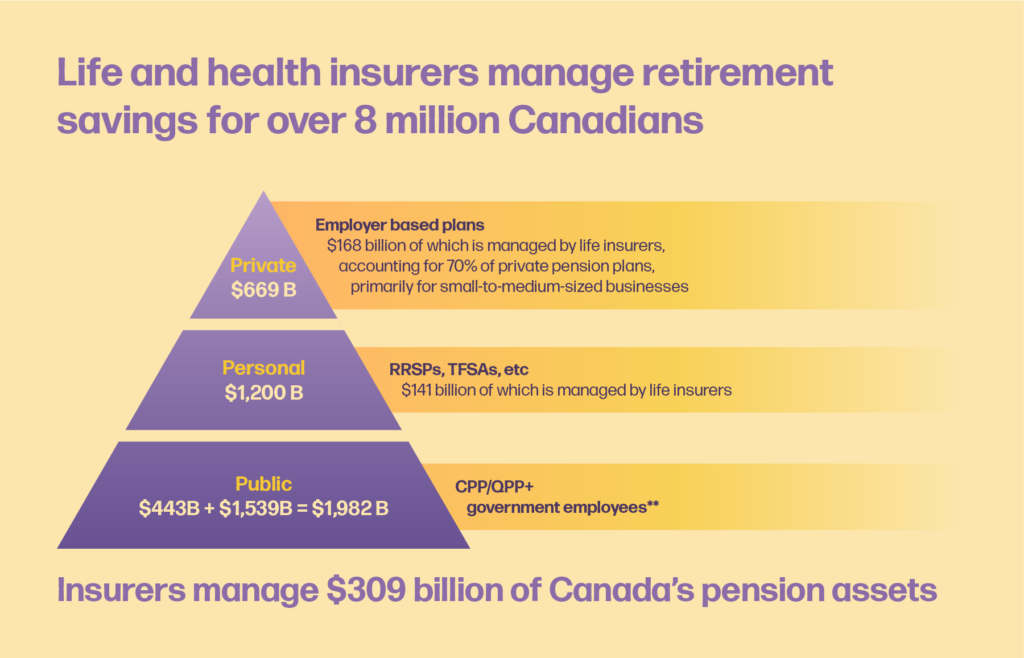

Life and health insurers play a significant role

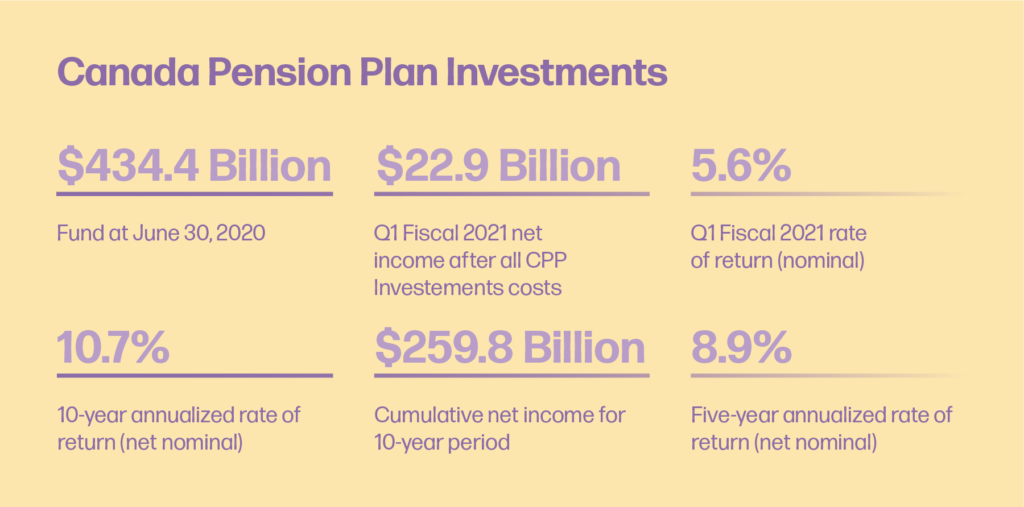

The Canada Pension Plan: an overview

The Canada Pension Plan (CPP) retirement pension is a monthly, taxable benefit that replaces part of a member’s income when they retire. If you qualify, you’ll receive the CPP retirement pension for the rest of your life. To qualify you must:

- be at least 60 years old

- have made at least one valid contribution to the CPP

The amount one receives each month is based on their average earnings throughout their working life, their contributions to the CPP, and the age they decide to start their CPP retirement pension. One’s contributions to the CPP are based on their earnings.

The standard age to start the pension is 65. However, one can start receiving it as early as age 60 or as late as age 70.

If one starts receiving their pension earlier, the monthly amount they will receive will be smaller. If they decide to start later, they will receive a larger monthly amount. There’s no benefit to wait after age 70 to start receiving the pension. The maximum monthly amount you can receive is reached when one turns 70.

For 2019, the maximum monthly amount you could receive as a new recipient starting the pension at age 65 is $1,154.58. The average monthly amount is $679.16.