Telemedicine services are seeing a surge like never before

Telemedicine is not a new industry, but it is one that’s rapidly evolving and gaining more traction every day. Its growth was only accelerated by the onset of the COVID-19 pandemic, which brought about a huge behavioural shift in the use of technology for virtually everything, from work to education to healthcare.

Telemedicine services include clinical care to patients through email, mobile apps, phone, or video calls. Using this technology, healthcare professionals can assess—and even diagnose—patients remotely. Over the last decade, telemedicine services have seen tremendous growth and innovation. These advancements have made quality healthcare more accessible to a growing number of people, among them the most vulnerable populations who cannot attend in-person appointments.

It’s not just patients who are benefitting from telemedicine. Healthcare workers in remote field settings can obtain guidance from colleagues elsewhere — supporting diagnoses, clinical care, education, and facilitating health administration.

While the adoption of telemedicine is growing exponentially, it does have its own set of challenges and obstacles.

Challenges facing telemedicine providers

Hybrid solutions are lacking

Though telemedicine services exist in most cases to supplement face-to-face care, a hybrid approach can leave patients wanting. Virtual and in-person solutions are often siloed, creating problems with continuity and interoperability.

A patient who consults a doctor virtually might later book an in-person appointment with another doctor. Without a common health record, the patient may spend more time explaining her health history and reiterating her concerns than receiving care. Such gaps can lead to unnecessary complexities, time wasted, and delays in treatment. Given these risks, organizations need to be strategic about offering an integrated and holistic operating model.

The vendor marketplace has attracted substantial amounts of investment and achieved record valuations. The investment dynamics of this industry are ripe for rapid consolidation. While there are different competitors competing for similar services, there is a need for continuous and rapid administrative evaluations — this could become a significant differentiator for a future dominant player.

Competition is tight

Consumers have easier access than ever to online information such as pricing, services, availability, and ratings for any healthcare provider they choose, allowing them to make informed decisions. This makes it a challenge for healthcare providers to stand out; even by adding cutting-edge technology, they are often only leveling the playing field, rather than gaining a competitive edge.

Even with its challenges, telemedicine is advancing and evolving quickly

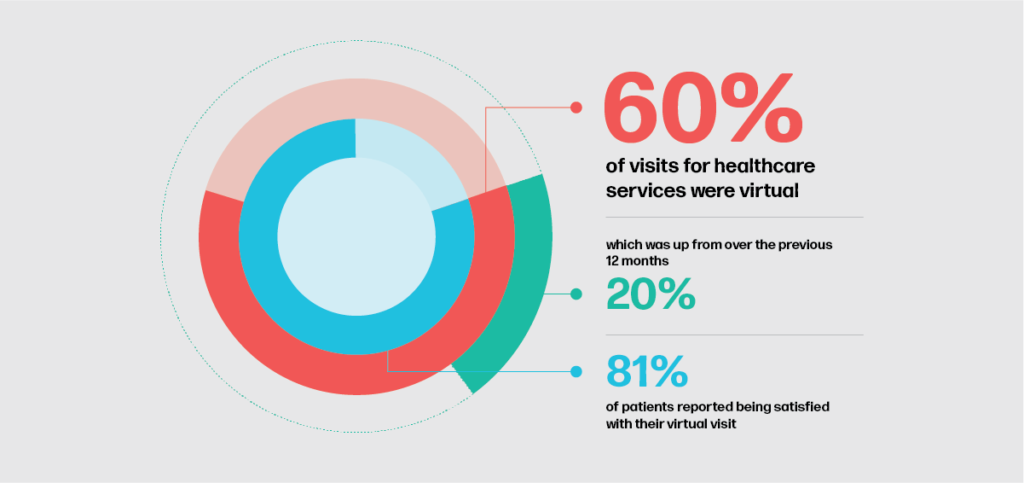

Healthcare being available with the click of a button has changed the way we think, access, adopt, and afford it. According to a report by Telus Health, at the end of April 2020, 60% of visits for healthcare services were virtual, which was up from 20% over the previous 12 months.

Virtual healthcare has grown by 240%, with virtual mental health services increasing by 114%. 81% of patients reported being satisfied with their virtual visit experience. Today, the global telemedicine market is expected to total $40 billion by 2021 and $175 billion by 2026.

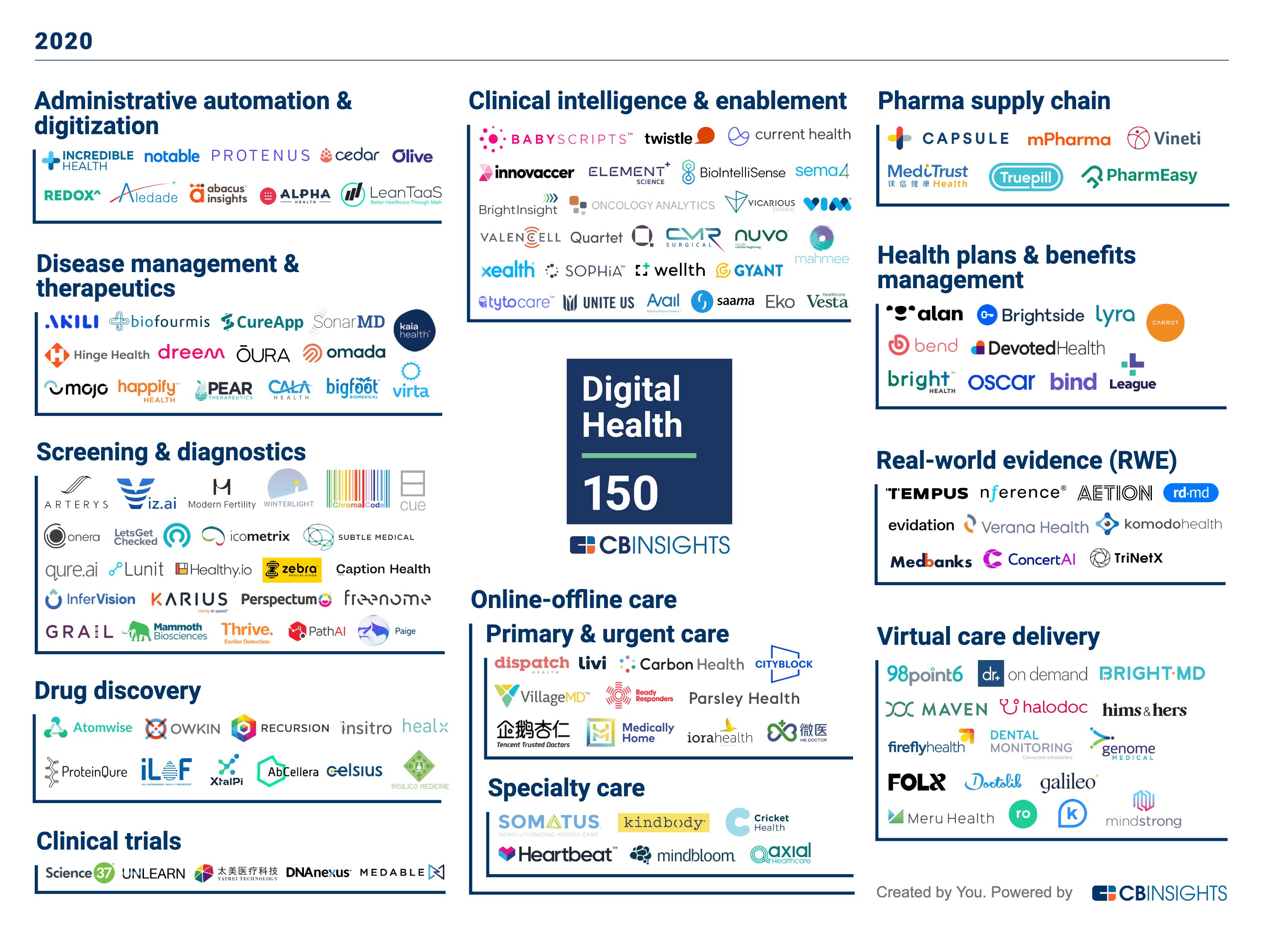

The most significant innovation in the health-tech space has come from start-ups that have initially been funded by venture capitalists and subsequently attracted ‘strategic’ investors.

Telemedicine providers are distributed across a number of segments

Healthcare startups have played a key role in solving some of the most pressing challenges in the healthcare space. They have been instrumental in bringing about key cultural and process changes for a wide scope of consumers. These private, VC-backed, Canada-based digital health startups have raised approximately $1,000M USD in total disclosed equity funding to date. According to the Canadian digital health market map by CBInsights and PwC, these investments have been distributed across startups contributing to three main categories:

Provider

The service provider segment is the most mature digital health category in terms of years active and greatest share of late-stage companies. Startups in this area have grabbed a 40% share in this space, raising approximately $380M USD to date.

These companies are focused on improving clinical intelligence, either through advanced monitoring and diagnostic systems or through clinical data and knowledge exchange platforms. Incorporating these digital technologies into their practice affords providers greater flexibility, improves efficiency, and enhances clinical decision-making.

Virtual practice management and “digital front door” solutions have increasingly come into focus as providers seek to rapidly virtualize their care delivery capabilities in the wake of COVID-19.

Patient

As the second-most populated segment, startups in this category have collectively raised $206.8M USD to date. They focus on consumers by anticipating their needs and taking a holistic approach to delivering health solutions through apps. By integrating with the lifestyles of digitally savvy patients, they seek to drive value through convenience, activate data-driven behavior change, and improve the cost and quality of care in the process.

Life Science R&D

As the youngest segment with $202.4M USD in funding, this end market is the only one that saw a mega-funding round in 2020. Technologies such as big data, computational biology, machine learning, and process automation are often explored here. The funding inflection in 2020, as evidenced by Vancouver-based AbCellera raising 144 million in a Series B round, has partially been driven by the urgent need to characterize COVID-19 and develop effective diagnostics, vaccines, and treatments against it.

The future of telemedicine is bright

Looking at these trends, the value they bring and the services they offer, we can safely predict that startups in the telemedicine space will continue to focus on building their expertise in providing discrete solutions for niche markets, instead of competing for the existing cluttered space. Telemedicine is much more than a trend and will continue to undergo rapid innovation.