Digital health companies are reshaping the healthcare industry, the pace of change being further catalyzed by the Covid-19 pandemic. The impact has been transformative across the healthcare value chain.

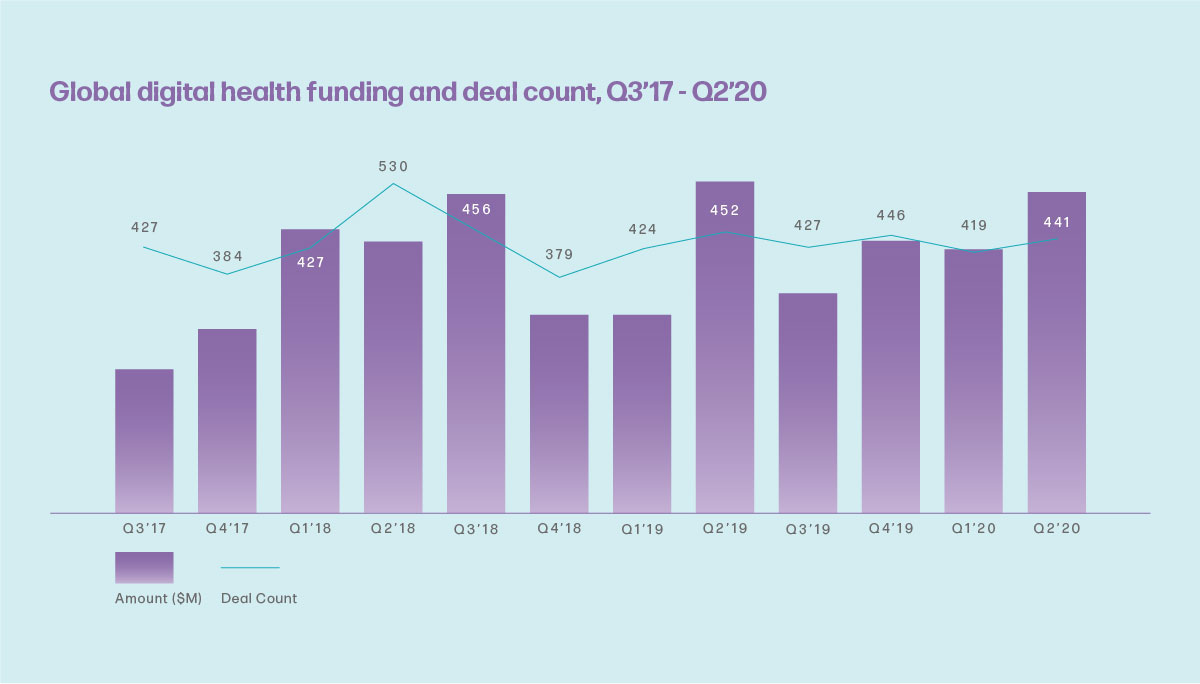

In 2020 digital health companies are poised to surpass the record-breaking funding levels of 2018 as investors seek to back transformative healthcare technologies and services. The global pandemic has only intensified investment and innovation in this space, as public health remains a priority for companies and investors alike.

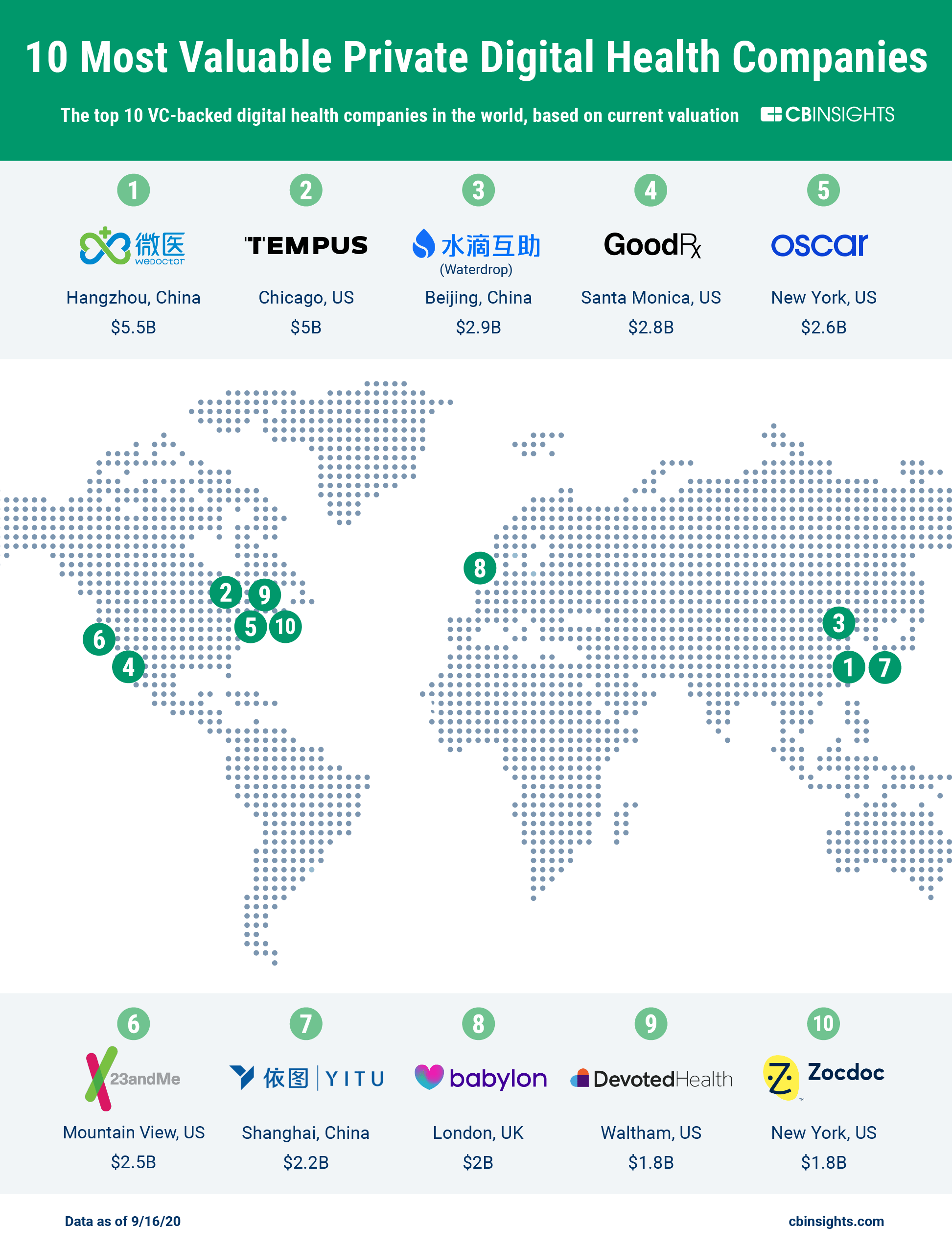

The Most Valuable Digital Health Companies

According to a CB insights research brief published in September 2020, the ten most valuable private digital health companies are worth in excess of US$ 29B. Other key takeaways from the report are summarized below.

Chinese players are rising quickly

We Doctor, backed by the tech giant Tencent, based in Hangzhou leads the cohort with a $5.5B valuation. The company reported that 50,000 doctors joined the platform since the coronavirus outbreak. Among the top ten, three are based in China. The impetus for healthcare reform came from the government’s objective of providing every Chinese citizen with healthcare at an affordable cost.

The United States has the leading contenders

Digital health startups raised over $17B across more than 1,700 deals in 2019. This represented a 2% increase from 2018’s funding record, with the New York based Oscar leading in total funding with $1.5B raised (CB Insights). In aggregate, the companies are working in different areas of the value chain such as telemedicine, insurtech and cancer detection.

Genomics funding is breaking records

The genomics category which encompasses companies involved in the capture, sequencing, and analysis of genetic data, is represented here by Tempus and 23andMe. The space continues to mature. The largest genomics funding round in 2020 YTD was a $1B Series B to China-based sequencing device, equipment, and consumables company MGI Tech (CB Insights). Demand for Covid-19 genetic tests has further accelerated the funding trend, with total global funding to private genomics companies projected to reach over $4.4B in 2020 (CB Insights).

Health insurance is a priority across the board

A number of these companies are working to improve health insurance access and management. In addition to Oscar, this category includes Devoted Health, which offers Medicare Advantage plans to seniors, with an aim to align incentives for patients and providers. It also includes China-based mutual aid insurance platform Waterdrop.

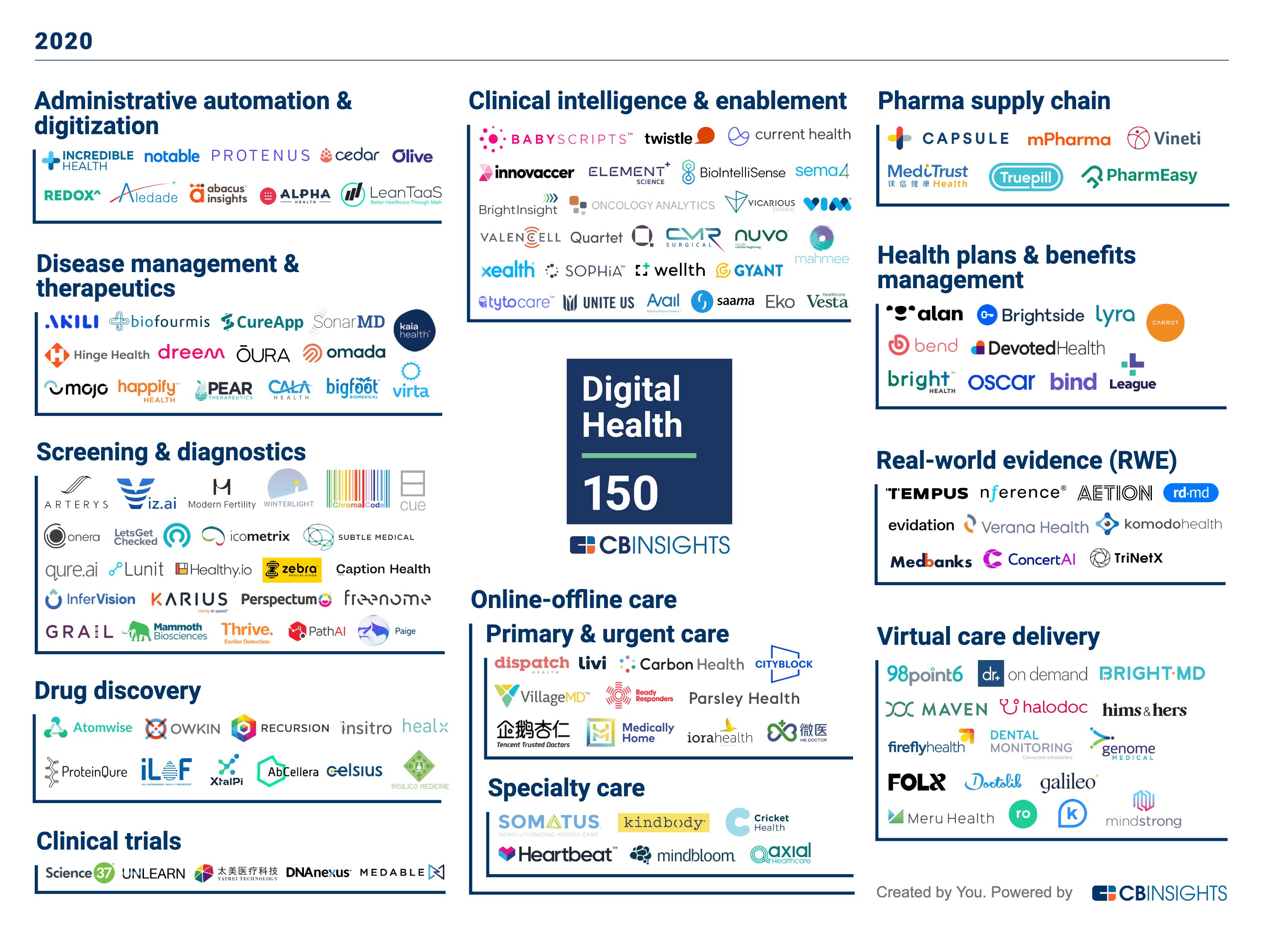

The Digital Health 150

CB Insights unveiled the Digital Health 150 this year, a list of the world’s top private digital health companies. These companies are dynamically changing healthcare for patients, providers, and payers.

Global Reach

The cohort currently represents 18 countries and includes companies operating across 12 categories. Within the cohort, 12 are “unicorns” (valued at $1B+). Funding for these companies ranges from seed to Series E+ and represent over $20B in total funding across over 600 deals from over 900 investors.

Key takeaways from The Digital 150

Telehealth is a critical to delivering care

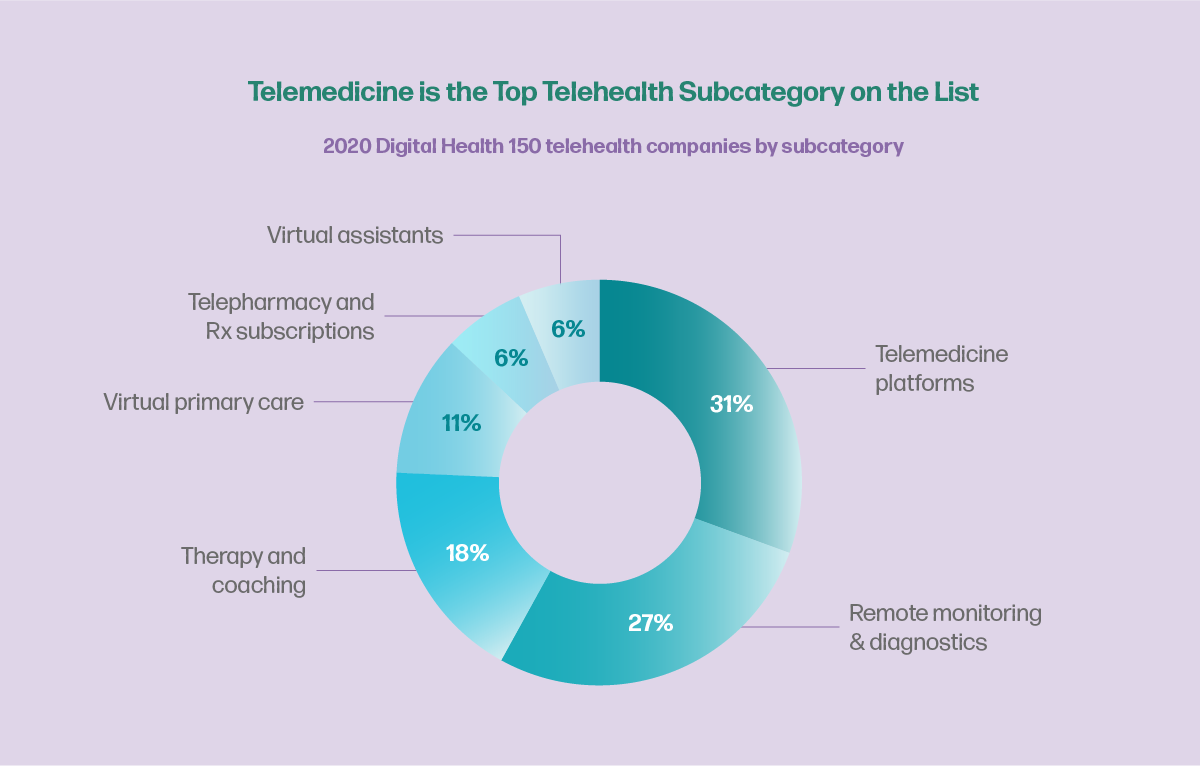

Sixty-two companies operate in the Telehealth space—that’s about 41%. This includes telemedicine platforms, remote monitoring and diagnostics, therapy and coaching, virtual primary care, tele-pharmacy and Rx subscriptions, and virtual assistants.

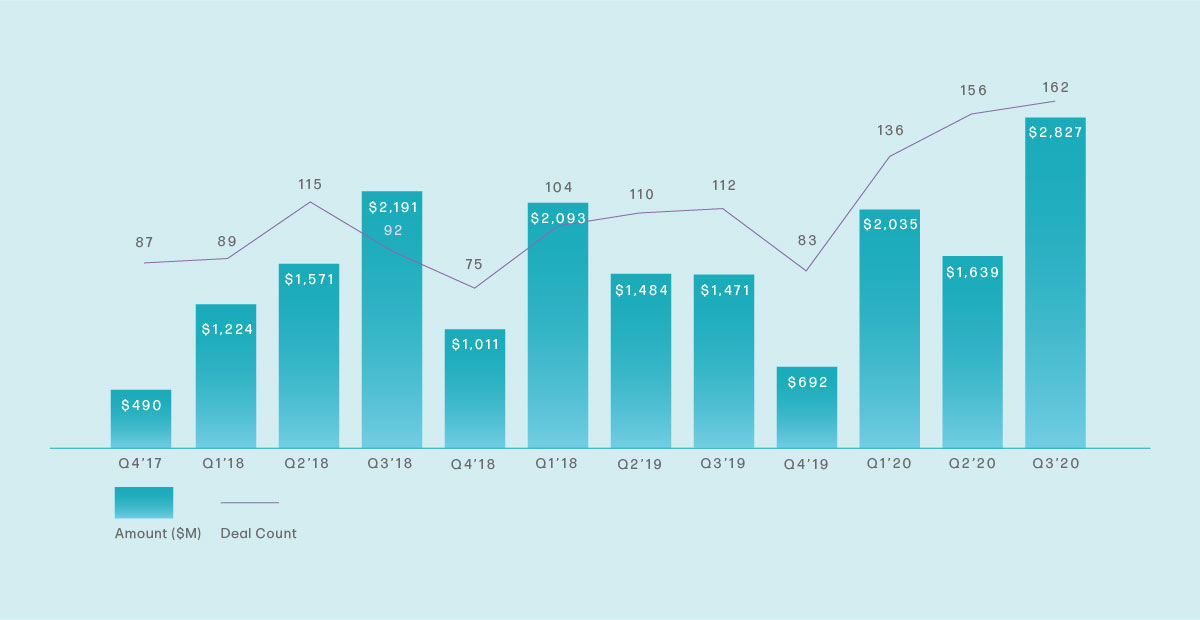

Looking at the deal count from Q4’17 to Q3’20 for telehealth startup funding, there is a compounded quarterly growth rate of 5.8%, while the deal amount grew by 17.2% from the same period.

Digital solutions enable mental and behavioural health services at scale

Ten companies are focusing on teletherapy and addiction management, operating under the categories of disease management and therapeutics, clinical intelligence and enablement, health plans and benefits management, virtual care delivery, online-offline care, and specialty care.

High drug R&D costs can be reduced by leveraging novel datasets

Twenty-six companies are focusing and operating under drug discovery, clinical trials, and real-world evidence (RWE) categories.

Optimizing healthcare costs is a growing priority for all stakeholders

Twenty companies are focusing on reducing costs for employers, providers, health plans, and patients. These companies operate under administrative automation and digitization, and health plans and benefits management categories.

The Pace of Digitalization is Accelerating

The dynamic nature of these companies is not just indicative of disruption, but also that many innovations are yet to come. In a world that’s been forced to adapt to remote distribution and increased uncertainty, it’s encouraging to see that funding is focusing on efforts that will increase care for the people who need it. One thing is evident, even in uncertain times, growth within the healthcare industry is a certainty.

References

- The 10 Most Valuable Private Digital Health Companies

- CB Insights: The State of Healthcare Report Q2’2020

- Trends, Insights & Startups From The Digital Health 150